by Sean Field

The electrification of heat and transportation is vital to the UK achieving Net Zero. With this in mind, the Scottish Government’s recent Heat in Buildings consultation paper highlights the need to reduce electricity prices in order to make the electrification of heat affordable. Without reducing electricity prices the Scottish Government’s Green Heat Task Force concluded that the electrification of heat would likely leave most households in a worse financial position when they replaced their gas boilers. Chris Skidmore’s independent report for the Westminster Government, titled “Mission Zero”, echoed similar sentiments.

Figure 1: Reports by the Scottish Government and MP Chris Skidmore

As I explored in my earlier blog posts “Natural Gas in the UK” Part 1 and Part 2, the UK’s electricity generation is dependent on natural gas – ranging from 6% to 60% depending on available renewable energy production and electricity demand (also see the most recent UK electricity statistics). While this dependence is falling, the way in which wholesale electricity prices are determined in the UK means that natural gas continues to play an outsized role in determining the country’s electricity prices. This came into sharp focus when wholesale gas prices – along with wholesale electricity prices – began to rise dramatically in 2021 amid rising geopolitical tensions between Russia and Ukraine (see “Natural Gas in the UK” Part 1).

Whilst reforming the UKs energy infrastructure away from natural gas dependence is a major and long-term process, changing how electricity is priced is an intervention that can be implemented much sooner. But, what might this look like?

In this short piece, I explore how a weighted average wholesale electricity price could reduce electricity prices for consumers and substantially delink wholesale natural gas and electricity prices. Delinking wholesale prices, I suggest, promises not just to insulate UK consumers from global natural gas price volatility, but also facilitate the electrification of heat and mobility by making electricity cheaper, which is essential for meeting the UK’s net zero targets.

How are Wholesale Electricity Prices Set in the UK?

National Grid is the company that is primarily responsible for moving electricity from where it is generated to where it is needed in the UK. It is also responsible for setting wholesale electricity prices. Managed and coordinated by National Grid, generators and suppliers buy and sell electricity in half-hour intervals, 24 hours per day, 365 days per year.

As Canay Ӧzden Shilling has shown in her book The Current Economy, balancing the supply and demand of electricity is complex. When demand exceeds supply, ‘brown’ outs and ‘black’ outs ensue. When supply exceeds demand, excess power can damage infrastructure. Maintaining the balance – the amount of electricity going into the grid and the amount of electricity being used from the grid – minute by minute, is a technological and infrastructural marvel. This is especially true when one considers the number of electricity generators feeding the grid and the millions of homes and businesses who depend on it.

The buying and selling of electricity between generators and retail suppliers can be bilateral, meaning they can work out a price and quantity between themselves, and inform National Grid before they physically trade electricity through the grid. Where there are no bilateral agreements or where supply and demand do not match, National Grid will manage the buying and selling of electricity to make sure the balance is maintained.

When National Grid manages supply and demand, they set a single wholesale price for retail suppliers. Since the early 2000s the UK electricity markets have operated using a single wholesale market price for electricity (see Natural Gas in the UK Part 2). To do this, National Grid will accept price bids from electricity generators to supply the grid with electricity. National Grid will accept these bids up until demand is satisfied, beginning with the cheapest and ending with the most expensive. It will then set a single market price for electricity for “all market participants”, based on the last and most expensive electricity supply bid available to meet demand, every half hour. Introduced in 2001, this system was initiated when at a time of low-cost gas and coal electricity generation and at a time when the Westminster Government prioritised the creation of a single electricity market for the UK.

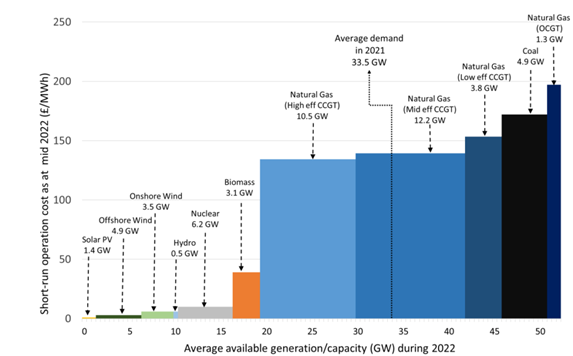

Analysis from the UCL Institute for Sustainable Resources has shown that in 2021 the UK often relied on ‘mid-range’ efficient natural gas electricity producers to supply the grid with electricity (see Figure 1). This means that the bid price set by these generators formed the single market wholesale price for UK electricity. Wholesale prices account for 50-60% of what consumers pay for electricity.

Regional Electricity Pricing

There are other models for setting wholesale electricity prices. The wholesale market for electricity can be divided into regions (or “zones”), where regional demand and supply determine prices. It can also be divided into “nodes”, which is an even more granular way of dividing the market up into micro-regions where local supply and demand for electricity drive wholesale prices up and down.

Various iterations of these models are used in the United States, France, Italy, Norway, Sweden, and other countries. It is important to keep in mind, however, that how these countries generate electricity varies – from natural gas and nuclear to hydroelectric – resulting in differing wholesale prices.

Octopus Energy’s Chief Executive Officer, Greg Jackson, has publicly called for the introduction of zonal electricity pricing in the UK, arguing that “customers will save hundreds of pounds a year on bills and parts of the UK will see the lowest electricity prices in Europe”.

While regional pricing models will result in lower electricity prices in some regions where local generation is readily available, other regions with lower or more expensive generating capacity will likely face higher prices. The implication would not only be disparities in electricity prices, but also rising energy poverty in regions where prices are set to rise.

For many regions in Scotland where onshore and offshore renewable energy is generated and coming online, this would likely result in much lower electricity prices – especially where fuel poverty is high.

A Weighted Average Wholesale Price

A weighted average single market wholesale price for electricity is another alternative. Under this pricing arrangement, National Grid would accept bids from generators up until demand is satisfied (as it currently does). Then, it would set the single market price for suppliers, who buy electricity from generators, as the total weighted average cost of electricity supplied to the grid, rather than set the wholesale price as the last most expensive bid price.

Let me illustrate with an example. Consider two scenarios: in scenario one, National Grid sets a single wholesale market price for all electricity generation based on the highest bid price, which is the current pricing system. In scenario two, National Grid pays generators their bid prices and sets a single wholesale price as the average weighted cost of supplying the grid.

Scenario 1: Current Highest Marginal Cost Model at £0.14/kWh:

| Type of Generation | GW | £/kWh | GW % | Total £ for GW |

| Solar | 1.6 | £ 0.010 | 4.5 | £ 229,950 |

| Offshore Wind | 9.1 | £ 0.012 | 25 | £ 1,277,500 |

| Onshore | 3.7 | £ 0.015 | 10.1 | £ 516,110 |

| Hydro | 0.6 | £ 0.015 | 1.7 | £ 86,870 |

| Nuclear | 3.7 | £ 0.020 | 10 | £ 511,000 |

| Biomass | 1.4 | £ 0.045 | 3.7 | £ 189,070 |

| High Efficiency Gas | 11.0 | £ 0.130 | 30 | £ 1,533,000 |

| Medium Efficiency Gas | 5.5 | £ 0.140 | 15 | £ 766,500 |

| Total | 36.5 | 100 | £ 5,110,000 | |

| £/GW | £ 140,000 | |||

| Wholesale | £/kWh | £ 0.14 |

Scenario 2: Average Weighted Cost Model for £/kWh:

| Type of Generation | GW | £/kWh | GW % | Total £ for GW |

| Solar | 1.6 | £ 0.010 | 4.5 | £ 16,425 |

| Offshore Wind | 9.1 | £ 0.012 | 25 | £ 109,500 |

| Onshore | 3.7 | £ 0.015 | 10.1 | £ 55,298 |

| Hydro | 0.6 | £ 0.015 | 1.7 | £ 9,308 |

| Nuclear | 3.7 | £ 0.020 | 10 | £ 73,000 |

| Biomass | 1.4 | £ 0.045 | 3.7 | £ 60,773 |

| High Efficiency Gas | 11.0 | £ 0.130 | 30 | £ 1,423,500 |

| Medium Efficiency Gas | 5.5 | £ 0.140 | 15 | £ 766,500 |

| Total | 36.5 | 100 | £ 2,514,303 | |

| £/GW | £ 68,885 | |||

| Wholesale | £/kWh | £ 0.07 |

The implication of an average weighted cost model is that wholesale prices would be below those set using the current model and retail suppliers could pass these savings on to consumers (especially if compelled to pass on savings by Ofgem’s retail price cap). The other implication is that as more lower cost renewable electricity generation becomes available, the more the average single market price of electricity will fall.

Another iteration of this model might blend regional and average cost wholesale pricing. For example, an average weighted cost model could be crafted for the Scottish, English, and Welsh wholesale markets. This could devolve wholesale electricity pricing and incentivise investment in regional renewable energy generation.

Electricity Prices & Energy Transition

Electrification is the lynchpin of the Scottish and UK Government’s plans to decarbonise buildings and homes (which account for nearly 20% of total emissions) as well as road transportation (which accounts for nearly 30% of total emissions). Decarbonising remains a formidable challenge because of the sheer scale of the transition needed, the high upfront costs of retrofitting, and the higher cost of electrified energy.

With this in mind, members of the Centre for Energy Ethics and the Scottish Research Alliance for Energy Homes and Livelihoods emphasised the need to reform wholesale electricity prices in a recent policy submission to the Scottish Government. The problem facing the Scottish Government, however, is that the power to reform electricity markets rests in Westminster.

If the transition to a low carbon society is to be achieved in a timely, just, and equitable manner, I suggest lowering electricity prices is vital. Here, I have introduced the idea of a weighted average cost model, which could be implemented rapidly and using the existing means by which to produce electricity. This is only one possible way of reforming the way that UK electricity prices are set.

These pricing models will not address the very real challenge associated with storing excess electricity from wind generation nor the infrastructure challenges ahead. What they will do, however, is reduce the outweighed influence of high-cost natural gas electricity on wholesale and retail electricity prices in the UK.