By Sean Field and Mette M. High

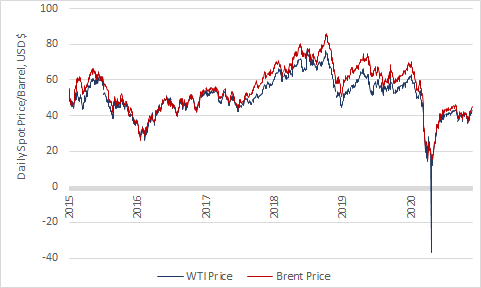

When West Texas Intermediate (WTI) crude oil plummeted to a closing price of –US $37.63 on 20 April 2020, the spot price of Brent crude oil only fell to US $17.36. This striking price difference between these two rival crude oil benchmarks highlights important dynamics that pertain to not only the supply and demand of oil, but also the social construction of futures markets.

In this series, we have been sharing our reflections on the causes and consequences of this historic fall in WTI prices and the importance of how these two crude oil benchmarks are physically and financially traded. In parts one and two, we reflected on how the physical-spatial dimensions of Brent and WTI crude oil factored into the sudden sharp drop in prices amid the COVID-19 pandemic. We showed how the US land-locked infrastructure for WTI is far less flexible than the sea-borne European infrastructure for Brent, making it less able to adjust to sudden changes in supply and demand. In part three, we explored how the CME-NYMEX futures market exacerbated the fall in the spot price for WTI. Market participants sold their WTI futures contracts en mass in the hours leading up to May’s futures contract expiry. These participants effectively paid counterparties so they did not have to take physical delivery of crude oil at Cushing, Oklahoma, at a time when excess supply already took up available crude storage.

In this part four, we share our reflections on the Brent Crude Complex – the interconnected system of financial and physical crude oil markets – and how it differs from the futures and spot markets for WTI. We show how the specific ways in which oil futures markets are constructed matter fundamentally for how monetary values are assigned to hydrocarbons in competing commodity markets.

Oil On ICE!

Brent crude oil futures are primarily traded on the Intercontinental Exchange’s (ICE) electronic trading platform. These contracts began trading in 1988 through the International Petroleum Exchange (IPE), which was bought by ICE in 2001. The contracts are also traded via the CME-NYMEX trading platform but in far lower volumes (just like WTI futures are traded on ICE but in far lower volumes than via the CME-NYMEX trading platform).

ICE is a major corporation that specialises in providing electronic exchange house and financial data management services. It was founded in 1997 when its founder, Jeff Sprecher, bought a technology start-up firm for US $1 with the aim of transforming it into a major provider of energy derivatives. ICE launched its trading platform in 2000, at which time the company also officially became known as ICE.

Brent, Complex by Design

Much like WTI futures contracts, ICE Brent futures contracts are traded for up to 22 hours per day, 6 days a week. Contracts are available for every month, eight years into the future and are priced in US dollars. However, unlike CME-NYMEX WTI futures contracts (see part 3), there is not a central location where ICE Brent futures contracts are converted into physical barrels of crude oil. Instead, Brent oil producers at regular intervals transport their crude oil via oil tankers from one of five terminals associated with different ‘streams’ that originate from dozens of oil fields in the North Sea. These ‘streams’ make up the Brent oil ‘basket’ with loadings from Brent, Forties, Oseberg, Ekofisk and Troll, collectively known as ‘BFOET’ (see part 1). The frequency of oil tanker shipments at the terminals depends on producers’ share of equity (ownership) in the oil fields and are coordinated with the respective volumetric production of these fields. From there, BFOET shipments are traded as ‘full sized’ cargoes of 600,000 barrels, which can be divided by producers into smaller units to be traded as ‘partials’.

The implication is that this physical market for Brent is controlled by a relatively small group of producers, which includes majors such as Shell, BP, Chevron, Total, Exxon, Suncor, Conoco, ENI and Equinor. These producers are among the few who have the financial and infrastructural capacity to trade in 600,000-barrel parcels. This control makes Brent’s oil supply highly coordinated and relatively stable, facilitating the mitigation of sharp surges in supply like those experienced in recent decades in the US with the advent of the ‘Shale Revolution’ and its flurry of exploration and production activity by new and established companies.

The other implication is that the vast capacity of Brent’s storage system is better able to handle moments of overproduction brought about by sharp declines in crude oil demand, for example during the COVID-19 pandemic. Brent’s numerous terminals and vast sea-borne infrastructure gives it an unmatched estimated operational storage capacity (onshore and offshore) of a staggering 5 billion barrels. By contrast, Cushing has an operational storage capacity of ‘only’ 76 million barrels. When the crisis of excess oil and limited storage at Cushing prompted the price of WTI to plummet in April 2020 (see part 2), the International Energy Agency (IEA) estimated that there was still 750 million barrels of operational crude storage capacity available in the Brent infrastructural system. Onshore Brent storage tends to fill up first because it is less expensive, followed by floating storage, which is more expensive but indispensable for Brent’s flexible storage capacity. According to the IEA, there are approximately 1,300 crude tankers in Brent’s global floating infrastructure with a collective capacity of 2.2 billion barrels of floating crude oil storage. When the surplus oil crisis struck in April, it is estimated that about 125 million barrels of Brent basket crude were being stored at sea and that up to 150 million barrels of floating storage space was still available. This vast and flexible storage capacity contributes to an infrastructure that is less susceptible to pronounced demand volatility.

In addition to the physical infrastructure, another key difference between these benchmarks relates to how these crude oils are traded. While WTI futures contracts expire around the 20th calendar day of each month with delivery to begin 10 or so days later, Brent futures contracts expire a month prior to the delivery period – well in advance of the delivery day. This leaves an entire month to arrange delivery for contracts in those instances where buyers and sellers have opted to settle through physical delivery of oil (called Exchange for Physical, or EFP).

This brings up another important difference with regards to the trading of these commodities: unlike WTI futures contracts, Brent futures contracts do not have to be settled through reference to physical delivery. Instead, they can be cash settled. Given the possibility of cash settlement, there is no potential risk of inadequate storage capacity affecting futures contract expiry. Cash settlement is the financial-infrastructural counterpart to Brent’s floating storage infrastructure. This combination gives the Brent Crude Complex the ultimate elasticity to match supply and demand dynamics.

Lastly, the settlement price of ICE Brent futures contracts is not the dollar per barrel price of the futures contract when it expires, as is the case for CME-NYMEX WTI futures contracts. Instead, ICE Brent futures contracts are settled at the ICE Brent Index price. The ICE Brent Index price is an average price calculated by ICE using information reported by private sector price reporting agencies (PRAs) S&P Global Platts and Argus Media. These agencies collect ‘forward’ and ‘dated’ price information daily from the Brent basket producers. ICE uses these ‘forward’ and ‘dated’ prices to calculate its index price, using only transactions of 600,000 barrels or more in its calculation. The ‘forward’ price refers to Brent basket oil that is scheduled to be shipped in the future but does not yet have a pick-up date at a terminal. Once these crude oil shipments are scheduled for pick-up at a terminal (usually a month before pick-up), oil is exchanged for ‘dated’ Brent prices.

The implication of the Index price is that the small group of multinational corporations that control the physical market for Brent crude is also indirectly responsible for determining the settlement price of Brent futures contracts. Buyers and sellers of ICE Brent futures contracts can bid on the price per barrel of these contracts through buying and selling activities on the ICE futures market, but the final settlement price is set to the ICE index. Thus, while futures prices influence spot prices by revealing future price expectations, the Brent system of relatively distinct markets and futures price indexing curbs the capacity of financial market participants to influence the spot price of Brent crude oil. As we explored in part 3 of this series, this was precisely the case for WTI – where it was futures market sellers who pushed the spot price of WTI below zero.

Constructing Regimes of Value

When the spot price of WTI oil sunk into negative territory on 20 April, the spot price of Brent crude did not similarly plunge. As we have discussed here, part of the reason is Brent’s massive and flexible storage infrastructure and the key role played by oil producers controlling and coordinating the supply of North Sea crude. Another reason is the way in which Brent crude is traded, where futures and spot markets prices are tethered together by the ICE Brent Index that is calculated with reference to the physical trade of crude – curbing the influence of futures markets on spot prices.

How and by whom crude oil is financially valued is not just a matter of chance but in large part a function of design. The market systems for financially valuing WTI and Brent crudes are demonstrative of two similar yet competing regimes of financial valuation. These regimes reflect different oil infrastructures and different perspectives on how oil should be financially valued. While the scale and complexity of the Brent system is vast, the power to determine and disseminate oil prices is concentrated in hands of an exclusive club of oil producers, PRAs, and ICE. Who influences the settlement price of futures contracts and how the price is determined may seem technical and boring, but this has huge consequences for how energy is valued and comes to circulate on a global scale. Although oil producers around the globe contribute to the international supply of oil that factors into the price of Brent (and WTI for that matter), 80% of world oil prices are benchmarked to the Brent basket prices – making the Brent Complex the most influential regime of hydrocarbon valuation in the world.

What this comparison demonstrates is that the construction of markets is vital to determining the value of oil. Producers may produce more or less, demand may go up or down, but it is not simply supply and demand that inform the prices of hydrocarbons. Far removed from the oil fields and from the places where hydrocarbons are used and combusted are highly abstracted marketplaces, largely invisible and unknown to the general public, where the financial value of crude oils is determined. These are the socially constructed crude oil complexes that shape in important ways our collective energy worlds.

In part five of our series, we explore some of the powerful participants in the WTI futures markets and contemplate their role in determining the value of oil and our collective energy futures.

Featured image photo credit: joiseyshowaa. Used in line with the licence CC BY-SA 2.0