By Mette M. High and Sean Field

For the first time in history, on Monday 20 April 2020, US oil futures contracts plunged into negative prices. A barrel of West Texas Intermediate (WTI) crude oil for May delivery fell from its Friday close of $18.27 to -$37.63 by the Monday. That is a 306% price drop in a single trading day – the largest price drop for the commodity since records began. This unparalleled situation meant that sellers were effectively paying buyers to take the futures contracts off their hands.

In a world that has been described as ‘petromodern’ and with oil as its beating blood, how can oil trade in negative prices? And how does this highlight the relationship between the physical and virtual dimensions of oil markets? Amidst a global public health crisis where COVID19-related lockdowns and other restrictions have led to a sudden and substantial reduction in oil demand, part of the answer has to do with infrastructures of oil production, storage and transportation. Other parts concern finance and how oil is traded on global commodity markets. In this series, we share a few thoughts on these issues as they struck us after negative oil prices became not just a possibility, but a reality – a reality that demonstrates the relationships between how we value place, space and capital.

In part one of this series, we focus on some of oil’s physical dimensions as it is locked into the specific geographies of place – its unique material qualities, how it is moved, how it is stored – and the void between the world’s two most ubiquitous oil benchmarks WTI and Brent, with a focus on the latter.

Oil Isn’t Just Oil

Crude oil is not a simple homogenous product. There are many kinds of crude oils with different chemical compositions, circulating through different kinds of oil infrastructures and attracting very different oil prices.

When oil is traded at market exchanges around the world, it is valued in relation to a specific price benchmark. There are numerous benchmarks, the two most well-known being WTI and Brent Crude (Brent). While WTI is a grade of crude oil that originates from the south central regions of the United States, Brent is a grade of crude oil that is extracted from the North Sea.

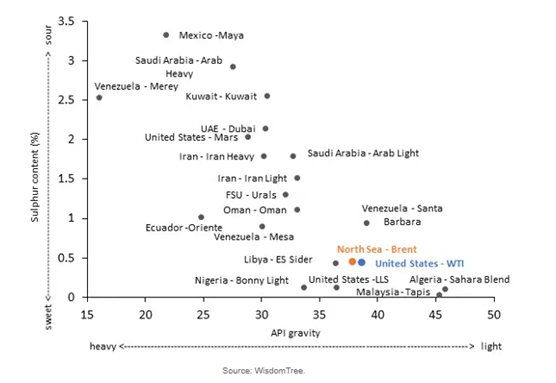

Crude oils from around the world have different chemical properties: They have more or less sulphur-content (making them ‘sour’ or ‘sweet’) and they are more or less viscous (making them ‘heavy’ or ‘light’).

WTI and Brent are crude oils that have remarkably similar chemical compositions – both WTI and Brent are considered ‘light’ and ‘sweet’ (see Fig. 1). WTI has an API (American Petroleum Institute) gravity of about 40 and sulphur content of about 0.24 percent. Brent has an API gravity of about 38 and sulphur content of about 0.37 percent. This affects how easy it is to refine these crude oil blends.

Figure 1: Brent and WTI have similar chemical composition

Although these two grades of crude oil are similar, WTI is actually slightly ‘sweeter’ (has less sulphur) and slightly lighter (has a higher API) than Brent. As a result, it ought to trade at a premium. But that has historically been far from the case. This makes WTI a generally poor gauge for the various oil prices around the world. By contrast, two-thirds of the world’s oil supplies are benchmarked to the price of Brent.

Many reasons have been given for this divergence between WTI and Brent, including regional demand variations, refinery capacity variations, depletion of the North Sea oil fields and the increased production from the North American unconventional reservoirs.

This divergence between WTI and Brent was particularly evident on 20 April 2020. On this day, when WTI plummeted to -$37.63, the price of Brent crude oil only fell to $26 (see Fig. 2).

Figure 2: WTI and Brent crude oil prices between January 2019 and May 2020. Source: Koyfin 2020.

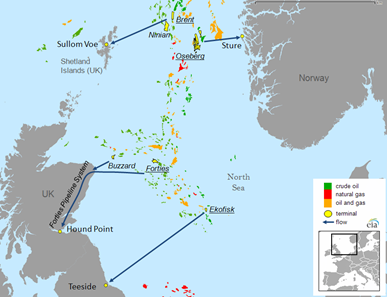

Originally from the Brent oilfield in the UK North Sea, Brent is a mixture of crude oils extracted from dozens of oil fields between the UK and Norway. The ‘lightness’ of these crude oils means they are easily transported via pipelines and collected into four separate ‘streams’: Brent, Forties, Oseberg and Ekofisk, collectively known as ‘BFOE’ (see Fig. 3). These streams are then delivered to four sea-side terminals: the Sullom Voe terminal (UK), the Hound Point terminal (UK), the Teesside terminal (UK) and the Sture terminal (Norway).

Figure 3: BFOE North Sea Oil Fields and Terminals. Source: USEIA 2013

At these locations, oil is stored in tankers and floating storage vessels until it is shipped around the world to oil depots. From there, it is piped or taken via sea routes, freight trains or road tankers to refineries and further storage facilities.

As a sea-oriented price benchmark for crude oils throughout the Atlantic basin, Brent is not limited by land-based storage tanks, recurring pipeline bottlenecks and onshore markets. Tankers and other offshore vessels are contracted to respond to the ebbing and flowing of production, consumption and exportation in the North Sea (see Fig. 4). This flexibility comes at a financial cost as oil tankers are one of the most expensive ways to store crude oil. Yet sea-borne freight enables oil producers, traders and marketers to access augmented capacity in line with supply and demand. While it is theoretically possible for Brent to exceed storage and processing capacity, it is unlikely and has not been an actual issue so far. By connecting fields with reservoirs of desirable ‘light’ crude in the Atlantic Ocean, Brent taps into the flexibility that is anchored in oil itself. Brent’s network of ocean wells, underwater pipelines, sea-side terminals and floating storage combines flexibility with adaptability in order to accommodate market dynamics.

Figure 4: Oil tanker on its way to Grangemouth from Rotterdam. Source: William Starkey 2013

This material flexibility and adaptability in Brent oil infrastructure encapsulate and animate experiences, expectations and visions of ‘petromodernity’. It can bring the desired quantities of oil when and where it is in demand. It facilitates a world of seeming energy abundance to come into being. While some of this energy will increasingly come from renewable sources, the oil infrastructure that is associated with Brent crude oil – its offshore platforms, floating vessels and teeming tankers – stand as symbols of oil’s immediate and ready availability.

However, this flexible oil infrastructure that can readily adapt to market dynamics is not similarly present for the crude oils that are gathered to make up the WTI blend.