By Mette M. High and Sean Field

When the ‘Shale Revolution’ began in the mid-2000s in the United States, no one could have predicted just how much oil it was going to produce. Seen by many in the industry as an engineering feat, the combination of horizonal drilling, hydraulic fracturing and other techniques brought new oil reservoirs into production and turned legacy oil fields, depleted from years of conventional production, into hives of activity. From being a historically massive net importer of oil, the US eclipsed Russia, Saudi Arabia and other countries to become the world’s largest producer of crude oil.

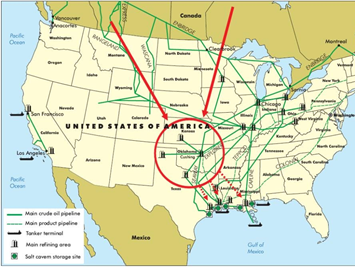

But the landlocked oil infrastructure that is used to move, store and refine the oil in the US was ill-equipped to deal with the surge of the light sweet crude that the Shale Revolution brought. Having been a net importer of oil for decades, the country’s refineries were set up to process heavier varieties of imported crude, particularly from Venezuela and Mexico. Although changes have been made to process more of the surging domestic production, the refineries remain predominantly old and better suited to process imported heavy crude. The pipelines are now under huge pressure to accommodate markets in both oil imports and oil exports.

When the West Texas Intermediate (WTI) price benchmark crashed at -$37.63 on 20 April 2020, well below its rival Brent (see part 1 of this series), the COVID-19 crisis exposed the serious limitations to this oil infrastructure in the US: The sudden reduction in global demand for refined petroleum products meant that refineries cut back their processing, wanting much less oil. Many US oil producers who were reluctant to shut in wells continued to bring oil to market, thereby raising the volume of crude oil stockpiles. With limited capacity to move this oil from its inland enclaves to export markets and with storage capacity at its limit, there was for a moment nowhere for US oil to go.

In this part of the series, we continue our reflections on some of oil’s physical dimensions with a focus on the place-based and spatial aspects of the oil infrastructure in the United States. The unprecedented concurrence of events in April 2020 revealed the importance of the relationship between WTI’s physical and financial dimensions. It was a historical moment that demonstrated how valuations of oil are tied to the specifics of place, the material dimensions of moving and storing it, and the dynamics of its trade.

Who Cares About Oklahoma?

In the early 1910s, the small town of Cushing, Oklahoma, nestled in south-central United States, became the site of a prolific oil boom. It happened when Tom Slick, later nicknamed the ‘King of the Wildcatters’, struck oil in 1912 and brought in a gusher close to Cushing (see Fig. 1). He had hit upon a giant oilfield, which later came to be significant for how the network of oil infrastructure developed over the next hundred years.

As soon as oil was struck in Cushing, word spread quickly. People flocked to the area and soon many more wells were drilled in the region (see Fig. 2). The small town boomed and grew into a centre for intensive oil exploration and production. As producers struggled to transport and market their oil, many began to build their own storage tanks and refineries close to the oilfield. Within a few years, there were 55 private refineries operating in the region. With tanks and refinery capacity in place, many oil companies from the wider region then built pipelines into Cushing, creating a crossroads of oil transportation and storage. It reflected the energy visions and ambitions of the time, where lives and livelihoods were created around crude oil. As an instantiation of an oil-centred economy and society, Cushing was becoming the place where oil market participants met and built dreams.

But the oil boom in Cushing didn’t last long. After only four years many wildcatters left for other prospects. Yet, given its relatively early establishment, its vast pipeline infrastructure and its great access to extensive railroad networks across Oklahoma, Missouri, Kansas and Texas, the small town of Cushing remained the strategic home to refineries, pipelines and storage facilities. While the refineries eventually closed, the oil storage facilities in Cushing continued to grow to become the largest in the world, giving the town its status as the “Pipeline Crossroads of the World”.

Pipelines and Oil Prices

This historical legacy anchors and informs the US’s oil infrastructure still to this day with Cushing being the main storage hub and delivery point of WTI crude oil. It is where CME-NYMEX WTI Crude Oil futures contracts are settled and the spot price is established. This means that when futures contracts for oil shipments materialise into physical exchanges of oil, it happens in Cushing.

Exchanges specify the conditions of delivery for the contract they cover, designating the storage facility and delivery location. The buyer has the right to either remove the crude oil from the designated storage facility or leave the commodity at the storage facility for a periodic fee. As such, the financial WTI contracts are tied to the underlying physical asset, local storage availability and pipeline access, even when most contracts are closed before their expiry date.

Positioned right at the intersection of two dozen crude oil pipelines that span in all directions across North America, Cushing presently has 15 oil terminals with a combined storage capacity of more than 90 million barrels (see Fig. 3). These oil terminals, along with pipelines and storage facilities, have the capacity to transport up to 6.5 million barrels per day from oil-producing regions to crude oil refineries, petrochemical plants and tank terminals (see Fig. 4).

Although this is the largest oil storage facility in the world and the US is host to more than ten times as many miles of crude oil pipeline than any other country, this oil infrastructure remains landlocked and fixed-capacity. There is limited pipeline capacity to transport crude oil in and out of Cushing, just as it has limited capacity to store crude oil at Cushing. Physical bottlenecks occur and reoccur, informing the oil economy and society that grew from the early visions and ambitions at Cushing.

These physical bottlenecks are exacerbated at a time of high oil production and further exacerbated when vast amounts of imported crude oil from Canada are transported through that same infrastructure across the country, especially to the heavy oil refineries clustering along the Gulf of Mexico. With pipelines now able to transport no more than 70% of domestic production, thousands of rail cars, tanker trucks and inland oil barges are relied upon to provide extra ‘swing’ capacity. These forms of oil transportation augment the amount of oil that is transported to market. Yet, they are relatively costly while still remaining subject to frequent logistical bottlenecks.

Navigating these bottlenecks, the Shale Revolution has thus given rise to intense competition among oil producers for pipeline access. It has emphasised the regional and landlocked nature of the US oil infrastructure to such an extent that those further from Cushing now trade their oil at sometimes heavily discounted prices to WTI while those involved in oil storage and marketing revel in highly lucrative business opportunities.

Space, Place and Oil

It matters what kind of crude oil is extracted and where it is extracted from as these factors predispose it to the challenges of storage, transport and trade. While Brent’s sea-oriented oil infrastructure has become emblematic of flexibility, fluidity and adaptability, as we discussed in Part 1 of this series, WTI’s oil infrastructure is fixed, rigid and limited by the landlocked pipelines and storage facilities at Cushing and elsewhere. If the Shale Revolution challenged people in the US oil and gas industry and beyond to reflect on current energy infrastructures and consider new energy possibilities, that fateful Monday in April highlighted WTI’s persistent limitations.

What the physical and spatial inflexibility of WTI leaves untold about the negative price of WTI on 20 April, is why the negative price spike was so acute and so short-lived. The price of WTI recovered the next day, on 21 April, to $10.01 per barrel.

The answer as to why the price of WTI went so low, so fast, has to do with how WTI is traded on global commodity markets. This is the subject of Part 3 of our series – ‘where the material meets the future’.