By Rukonge Muhongo and Ifesinachi Okafor-Yarwood[i]

Rare minerals are essential to everyday digital products and renewable energy technologies. Tungsten, for example, is a critical component in vibrating phones. Light-emitting diode (LED) bulbs contain gallium and indium, and silicon is an essential ingredient in semiconductors. Rare minerals, such as cobalt, are vital for the production of hydrogen fuel cells and electrolysers. Without lithium, there are no lithium batteries or electric vehicles. Without copper, there is no thermal conductivity in residential heating systems.

Given this broad and fundamental use of rare minerals, demand for rare minerals is fast rising. Investors are withdrawing from the fossil fuel sector in favour of rare mineral-dependent renewable energy technologies, and rare minerals are central to realising the 2050 greenhouse gas emission reduction targets set out in the EU’s European Green Deal, Climate-Neutral Economy and the Paris Agreement. Climate adaptation and mitigation initiatives brought about by international conventions such as the Paris Agreement (COP21) have become the main driver of rare mineral trade flows. The quest for net-zero emissions has enabled companies and investors to harness a wave of low-carbon technology innovation, develop new goods and services, and create new jobs in the renewable energy sector. China, the world’s largest investor in renewable energy, is set to run the country’s electrical grids on at least 62% renewable energy by 2030 for example. The growing demand for renewable energy technologies is expected to increase the demand for rare minerals like cobalt, lithium, and graphite by nearly 500% by 2050. Over 3 billion tons of rare minerals will be needed to generate solar, wind, and geothermal power, as well as battery storage technology to achieve the global goal of reducing emissions to net-zero. It follows that environmental policies aimed at tackling the impact of climate change are leading to a new scramble for rare minerals in Africa as governments and companies compete to create low-carbon economies.

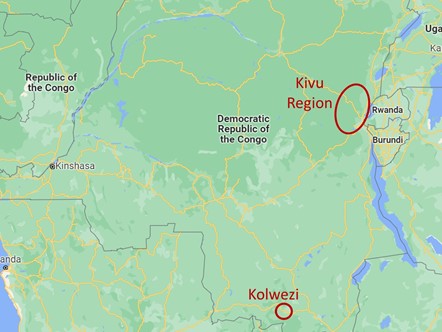

These rare minerals are the last trump card held by Sub-Saharan Africa in its move towards achieving natural resource-based structural transformation and sustainable development as envisioned in the ‘African Union Agenda 2063: Africa we want’. Sub-Saharan Africa is the farmland of these crucial global rare minerals. Yet, the economic benefits of these rare minerals have not trickled down to the host mining communities such as Kolwezi and Kivu in the DRC.

Tesla, for example, agreed to buy 6,000 tons of cobalt annually from Glencore as raw material for the rechargeable batteries powering their electronic vehicles. The deal raised eyebrows as Glencore is obligated to pay Dan Gertler 2.5% of sales from its mines in the DRC. Gertler is an Israeli billionaire and the owner of Oil of DRCongo company, allegedly at the centre of corrupt copper-cobalt transactions. He has been sanctioned and blacklisted by the U.S Justice Department since December 2017 due to his dealings in the DRC. Gertler is set to gain between $4-5 million in annual royalties from the Glencore-Tesla deal. Local communities are expected to benefit little, if at all.

The DRC has a long history of exploitative resource extraction and maladministration. Demand for rare minerals prompted by energy transitions in the Global North has extended this legacy in new ways. Rare mineral extraction, for example, is exacerbating poor human rights practices and labour exploitation. According to UNCTAD, 20% of the cobalt supply from the DRC comes from artisanal mines where child labour and human rights abuses have been reported. An estimated 40,000 children work in those mines in dangerous conditions being paid less than $2 a day. Artisanal and small-scale mining make up 15-30% of cobalt exports, which is processed in Belgium, China, Finland, Norway, and Zambia. Cobalt has also fuelled insecurity attracting more than 130 armed groups in eastern DRC’s North Kivu, South Kivu and Ituri provinces. The DRC artisanal cobalt supplies are integral to some of the best-known brands of electronics and digital devices globally, including: Apple, Dell, Hewlett-Packard, Huawei, Lenovo, LG, Microsoft, Samsung, Sony, and Vodaphone. These companies, however, are reluctant to speak out on the human rights abuses in the cobalt supply chain. Governments and corporations in the Global North – the primary consumers of these rare minerals – have yet to officially recognise the harsh realities of rare mineral supply chains.

Human rights abuses in the DRC’s cobalt mining sector led to a class action lawsuit in the US District Court for the District of Columbia against Apple, Alphabet, Google, Dell, and Tesla. The lawsuit, filed by 14 families in the DRC, accuses tech companies of knowingly aiding and abetting forced labour practices in the country. The tech companies filed a motion to dismiss the charges claiming they did not know about the abuse of human rights and the involvement of child labour. Though such a lawsuit is a significant development addressing the real-life experiences of sourcing cobalt from the DRC, it does not address the problem and human rights abuses continue to be reported in these artisanal mines.

In response, some companies have begun to look for ‘ethical cobalt’. Automotive industry leaders such as Tesla, BMW, Volkswagen, and Ford are looking beyond the DRC. BMW, for example, signed a $110 million agreement for cobalt from Morocco’s Bou Azzar Mine. Companies such as Glencore, meanwhile, have started looking to North America for cobalt: in Ontario, Canada, and in the US states of Missouri and Michigan. It will be difficult to move away from the DRC, however, since it boasts approximately 3.6 million tons of cobalt reserves. North America, meanwhile, has only 230,000 tons of cobalt reserves and cannot sufficiently supply the global cobalt market. This makes the DRC the dominant and reliable global supplier of cobalt.

Some companies have committed to responsible sourcing through the Responsible Metals Initiative (RMI), which has promoted the adoption of blockchain-enabled solutions for ethical sourcing. For example, Ford, Huayou Cobalt, IBM, LG Chem, and RCS Global have employed blockchain technology to ensure transparency in their cobalt supply chains. The use of blockchain technologies help companies see exactly who mined the rare minerals and how it was transported across the supply chain—giving investors’ confidence on the ethical mining conditions in compliance with the OECD’s ethical supply chain guidelines.

Geopolitically, the United States is looking to develop the downstream segment of their cobalt supply chain to counteract China’s refining and manufacturing dominance. Whilst China boasts more than 75% of worldwide battery cell fabrication capacity, the United States boasts less than 10%. China produces approximately 70% of the world’s polysilicon for solar panels, by contrast with the US’s 9% share of global production, and China manufactured 80% of the transformers installed in the US’s electrical grid in the last decade. China is the only country in the world with complete control over every phase of the supply chain for critical minerals, such as cobalt found in lithium-ion batteries, and it controls 80% of global raw cobalt refining capacity. Such refining capacity forces western companies like Tesla to be dependent on the DRC-China cobalt supply chain.

Conclusion

Like other renewable energy technologies, electric vehicles are not a luxury switch from one car design to the other. They are a necessity for meeting carbon reduction targets and transitioning away from fossil fuels in countries around the world. Countries like the United Kingdom have devised a ten-point plan for a green industrial revolution to mitigate the climate change crisis. It calls for new adaptive measures across the housing, transportation, aviation, and energy sectors making the ten-point plan a historic turning point on climate action. Evidently, Boris Johnson’s ten-point plan for the green industrial revolution cannot be materialised without the DRC’s cobalt or China’s refining capacity.

The current public and policy discourse in the Global North has been limited to the utility of these minerals. Alternatively, the Natural Resource Governance Institute states that “G7 (GN) countries cannot secure supply of rare metals without tackling governance and corruption issues”. This is because the extraction of these rare minerals has raised concerns in the DRC about child labour, environmental degradation, political instability, and corruption, which are yet to be addressed by policymakers and multinational corporations.

As governments and corporations in the Global North call for energy transitions, they must do more to meet the needs and concerns of the cobalt mining communities in the DRC today. The use of blockchain technologies to ensure more transparency in cobalt supply chains is promising. The construction of domestic refining capacity also promises to grow the DRC’s economy and create local jobs. Furthermore, creating a “Copper-Cobalt African Agenda” for rare minerals over the next fifty years will aid in the development of policies and measures against the human rights violations in the DRC by ensuring the development of these minerals considers the wellbeing of the people and conservation of the environment through increased monitoring and policing. It would also promise to increase the equitable distribution of the monetary returns to the mining communities in the DRC who are primarily involved in cobalt extraction.

Rare minerals are essential for global energy transitions and are expected to attract $11 trillion of investment by 2050. As we suggest here, the DRC will remain at the centre of rare mineral supply chains for years to come. The question is: Will corporations and governments in the Global North forge new, more prosperous relationships with, and for, the people and communities of the DRC? Or will they repeat historic patterns of human and environmental exploitation under the guise of energy transition?

[i] Visiting Scholar, and Lecturer, School of Geography and Sustainable Development, respectively